audit vs tax big 4

I recently got an offer to become a Tax Associate with the Big 4 working specifically on financial instruments. Deloitte Audit vs MNP Audit vs PwC Tax So I got the following offers all for Vancouver Canada.

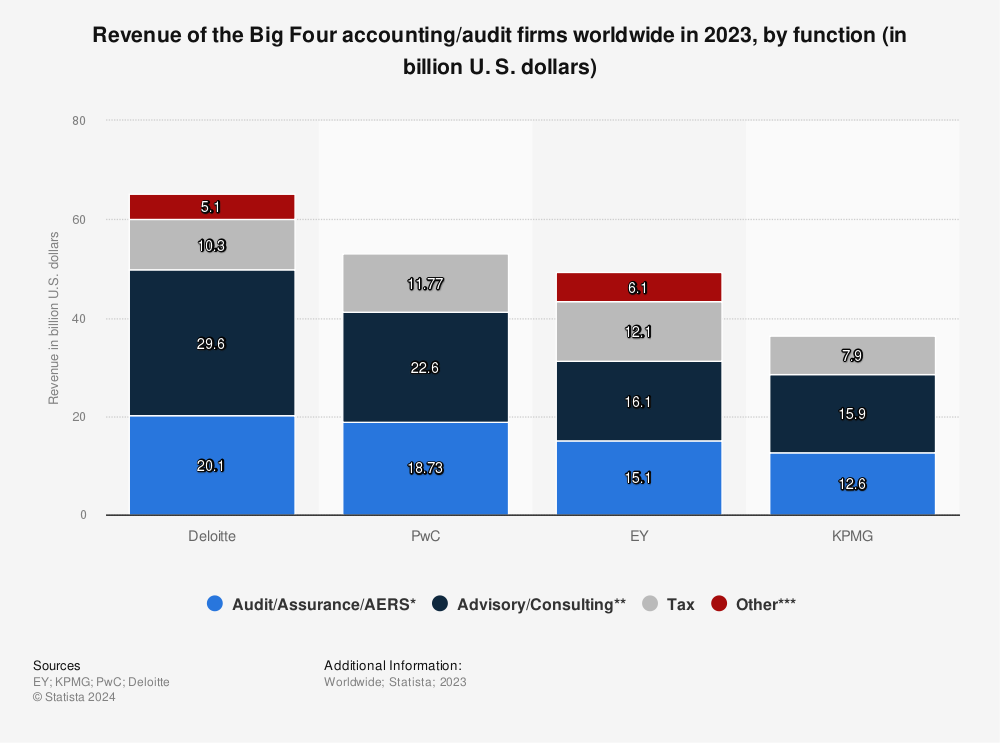

Big 4 Accounting Firms Ranking Revenue And Salary Igotanoffer

Which practice is better for you Audit or Tax.

. Getting into the big 4 especially in audit can make for a very promising career. Today we will be covering the pros and cons of working in audit or tax accounting at the big 4 accounting fir. Audit vs tax big 4.

MNP - 55k for Audit OT. PwC - 54k for Tax. However at this time.

Both tax and audit are within a big four. According to glassdoor the average CPA salary is 73825. I really like audit but dont mind tax.

According to the bureau of labor statistics the average median pay for accountants is 68150. Audit is lowest paying but is a solidstable path to a good career. Im in corporate tax for a publicly-traded tech company but was previously in corporate tax for a large life insurer - pretty much every one of my colleagues Ive worked with.

Big Four Accounting. More intense work schedule especially during busy seasons. Consulting is highest paying and probably most interesting depending on the specific type.

Hey folksIn this video I want to address a question I once had when deciding which career path to choose within the Big 4. The Big 4 is the name given to the four biggest accounting firms in the world PwC EY KPMG and DeloitteAll of them have grown to be multi-billion-dollar firms that employ. When I started my career Id have chosen Big four.

Difficult question one only you can answer. Tax is more specific to jurisdiction so you cant transfer across world. 06192014 I wanted to gather opinions on the ideal industry path within Big Four CPA firms.

Big 4 Audit Vs. As a Tax Manager at one of the Big 4 Ive been happy with my dec. A Big 4 consultant may exit to MBB while a TAS may exit to BB IB.

Are you interested in a career in accounting but dont know whether to choose Tax or Audit. Ziphoblat 4 hr. One caveat is that many firms will not hire undergrads directly into their TASFAS groups.

I work in tax. Audit is way better. In all seriousness the tax vs audit.

Possible exit to controller or CFO more client oriented work more career autonomy than Tax. Hopefully I can help you unders. Answer 1 of 3.

Alchemy-16 19 hr. Audit vs Tax Originally Posted. Deloitte - 55k for Audit.

Which practice is better at the big 4. Hey folksIn this video I want to address a question I once had when deciding which career path to choose within the Big 4. Both supply such services to.

Tax pays better but kind of pigeon. To me tax requires a lot. Depends entirely on your specialism.

Advisory careers with a company like KPMG can.

Audit Technology Evolving Quickly At Big4 Companies Cyberbooks Accounting Online Bookkeeping And Tax Filing Services For Your Small Business

How To Choose Between Tax Or Audit Big 4 Accounting Firms Kpmg Deloitte Ey Pwc Youtube

Audit Vs Assurance Top 5 Best Differences With Infographics

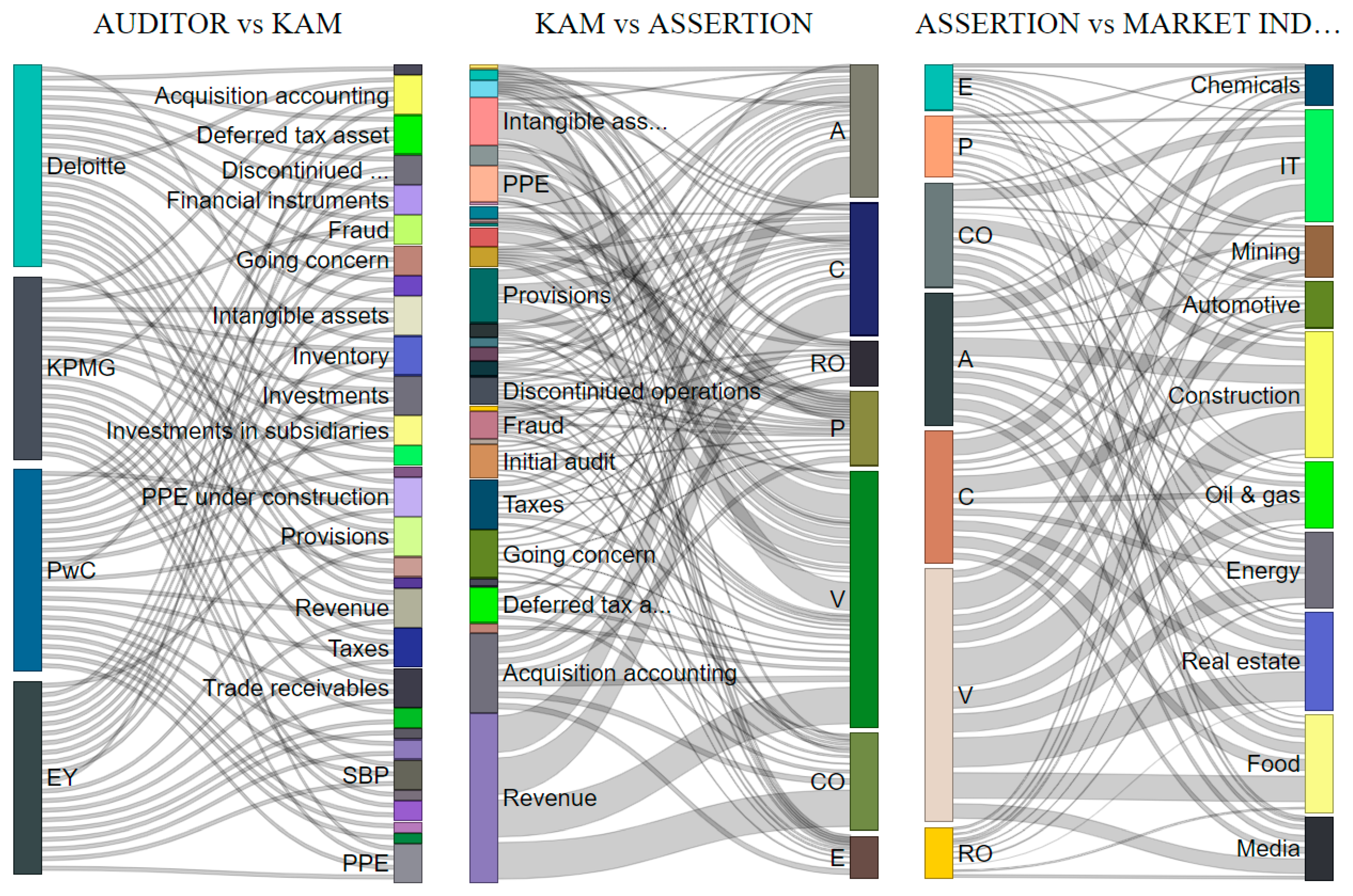

Jrfm Free Full Text Isa 701 And Materiality Disclosure As Methods To Minimize The Audit Expectation Gap Html

Tax Haven Networks And The Role Of The Big 4 Accountancy Firms Sciencedirect

Tax Vs Audit A Q A With Bs In Accounting Program Director John Barden Naveen Jindal School Of Management The University Of Texas At Dallas

Tax Or Audit L Why I Chose Tax And How To Decide For Yourself L Advice From A Cpa Youtube

What Are The Differences Between The Big 4 Preplounge Com

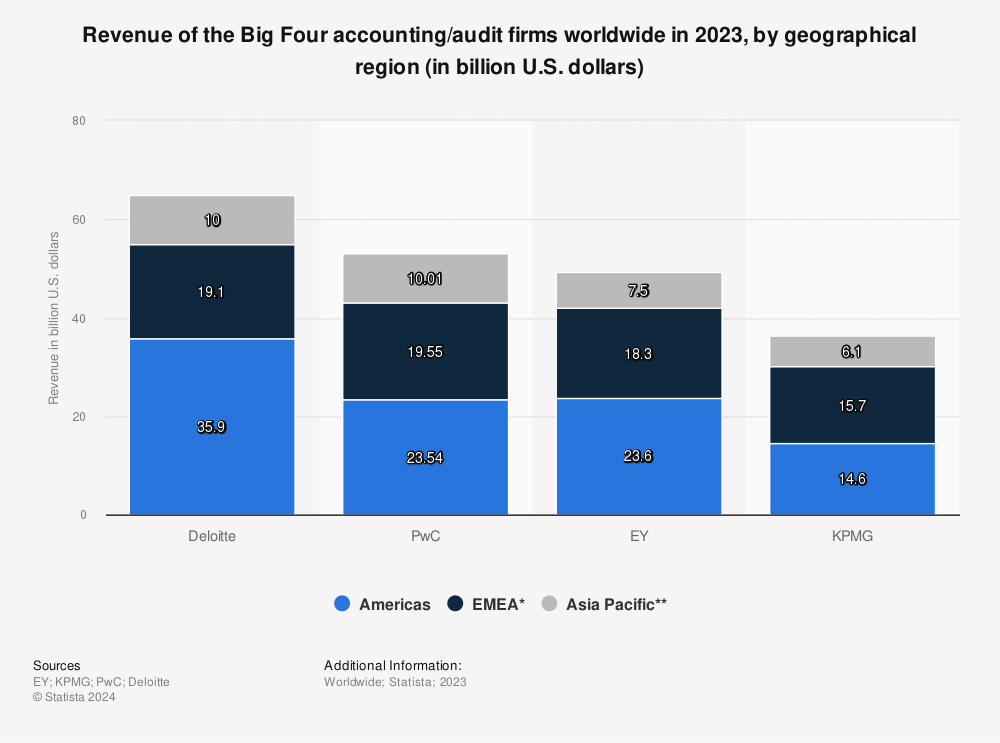

Big Four Revenue By Region 2021 Statista

Big 4 Consulting Firms Deloitte Ey Pwc Kpmg Mconsultingprep

The Practice The Reemergence Of The Br Big Four In Law

Tax Day 2018 25 Top Georgia Companies Paid Big 4 Accountants 250m In 2017 Video Atlanta Business Chronicle

Top Accounting Firms Most Prestigious Accounting Firms

The Big 4 Experience Pros Cons

Big 4 Transaction Services Careers Recruiting And Exits

How Does The Hierarchy At The Big Four Pwc Ey Kpmg Deloitte In Their Consultancy Wings Compare To One Another In Terms Of Seniority Quora